Futures investors utilize various technical 해외선물 analysis tools to make informed market choices. A generally utilized method is the moving average crossover, which aids area patterns as well as recognize potential entry/exit points while handling risk efficiently.

What is a Moving Average Crossover?

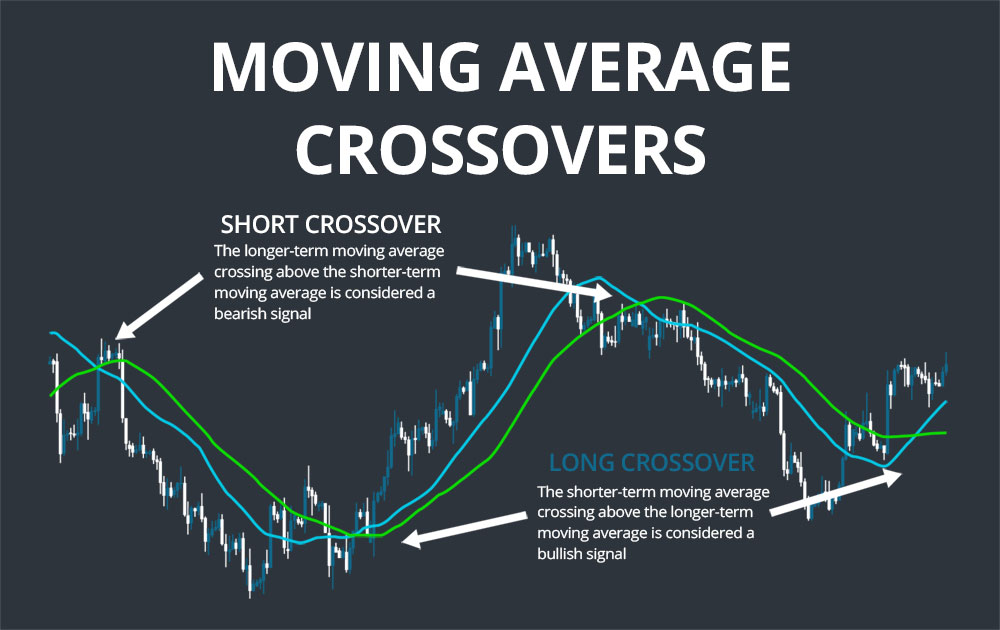

Traders pay close attention to moving average 선물옵션 crossovers as they may show that a change in the market fad impends. When a temporary( e.g., 10-day) and also long-lasting( e.g., 50-day) relocating typical cross courses, it’s time for traders to take into consideration changing their placements appropriately.

Traders commonly take advantage of moving average crossovers to gain insights 해외선물커뮤니티 right into the marketplaces. A bullish crossover happens when the temporary indicator leaps over the lasting reading, signifying a feasible uptrend in price. On the other hand, if this going across takes place descending after that bearish problems may be suggested – closing of existing positions or opening up new ones with caution is recommended.

How to Use Moving Average Crossovers in Futures Trading

- Identify the Trend: Moving average crossovers are a fantastic way for 해외선물대여계좌 investors to recognize trends in the marketplace. Short-term and also long-term moving averages can assist find bullish energy, with temporary crossing over the long term showing growth, while a bearish view is shown when those values move below each other.

- Determine Entry and Exit Points: Traders can use moving average crossovers to identify potential trading chances. When a favorable crossover takes place, it may suggest the right time for investors to open lengthy placements in anticipation of costs rising. Alternatively, when bearish signals appear, they may be a sign that present trends are reversing and also inspiring further action such as leaving or going into brief settings.

- Manage Risk: Risk management is a crucial part of futures trading, and also 해외선물사이트 moving average crossovers can assist investors take care of risk properly. Investors can use stop-loss orders to restrict their losses in case the market moves versus them. They can additionally utilize tracking stops to secure profits as the market relocates their support.

- Incorporate with Various Other Technical Indicators: Moving average crossovers can be incorporated with various other technical signs to confirm signals as well as boost the accuracy of trading decisions. As an example, traders can utilize trend lines, support and resistance levels, and momentum indicators to confirm the direction of the fad and also recognize prospective access as well as departure points.

Final thought

Through the tactical use of moving average crossovers, traders can unlock an effective means 해외선물정보공유 to obtain insight into the futures market. By examining patterns, setting entrance and exit factors, managing danger meticulously, and also supplementing with other signs – all choices come to be extra notified which brings about higher trading revenues.